Contact Info

- Address:

- 112 Water St, Boston, MA 02019

- Phone:

- (877) 684-4754

- Email:

- support@gameplan.com

- Homepage:

- https://gameplan.com/

- Home » Sports & Training » Tool & Supplement

-

We often discuss the difference between owning a business and being an entrepreneur where the latter often means being innovative in the process.

Andrew Bachman has a different perspective on entrepreneurship and that is focusing on revenue first and then being innovative. With the sale of his former internet marketing company, Tatto Media for $60 million, Andrew discusses what business models worked best for him, how to grab the attention of an angel investor, what getting acquired feels like and much more.

His latest venture is Game Plan Nutrition, a nutritional fitness company aimed to revolutionize that niche market.

It seems you were always an entrepreneur at heart. How did that happen?

When I first came out of college, what I thought I wanted to do was get a job to make $100,000 a year in finance so I could live downtown and have an apartment. But it didn’t quite pan out.

When I first came out of college, what I thought I wanted to do was get a job to make $100,000 a year in finance so I could live downtown and have an apartment. But it didn’t quite pan out.

I had conversations with my father and he is like a conservative Jewish doctor. He’s very risk averse and very different than the way I think, but I had conversations with him where I’d say, “I’d rather be broke for five years than have a job that paid me $60,000-$100,000 slaving away at a 9-5”. That time is so valuable when you look back at it. We all have what we need. We’ve all got friends. Some of us have good family where we can sleep on their couch. You can eat, you can live, you can sleep, but a 9-5 everyday and not having a social life and the sacrifices you make because you have to wake up and go work for someone else and get treated like a dog, it’s not worth it.I would rather have had nothing for a couple of years but work on my concepts and learn than taking the traditional approach.

With risk averse parents, how did you overcome that pressure of getting a stable job versus starting a business?

With risk averse parents, how did you overcome that pressure of getting a stable job versus starting a business?

There was no pressure but anxiety. A lot of people say that college is the greatest time of their life, but those are the average sheep and the reason why they feel that way is because in college, you’re given an overlying goal: graduate. Don’t fuck up, don’t piss your parents off, go out, get laid, party, fuck around but keep skating by and just graduate. Then all of a sudden, graduation comes. You’re out in the real world and that overlying goal isn’t there anymore.

What do I do now? That’s when people freak out and you see them at the crossroads in their life like, “I just need to get a job and get my parents off my ass.”  Sometimes you have to step outside the boundaries. Making money definitely relieves a lot of pressure because you don’t have to rely on someone financially. You don’t have to communicate with them and say, “I need this. I need that.” Obviously, that’s a big deal but at the end of the day, we all have to realize that our own existence is our own responsibility.

Sometimes you have to step outside the boundaries. Making money definitely relieves a lot of pressure because you don’t have to rely on someone financially. You don’t have to communicate with them and say, “I need this. I need that.” Obviously, that’s a big deal but at the end of the day, we all have to realize that our own existence is our own responsibility.

No one’s going to pay my rent and no one is going to build my lifestyle except me. Not my parents. For me, making a little bit of money gave me a lot of confidence and it gave me clarity that I could go out and do it again and not have to rely on anyone. I think when I talk and when I speak like that, a lot of people that don’t have that, it rattles them. They say, “I want that too” and I think that what you’re really going to remember is having confidence and acting as if and just being a bit of a savage really goes a long way.

What were some of the first business ventures you got into?

I am always, no matter what I’m doing, I’m in the money business number one. If I’m in mobile, supplements, or the hedge fund business, I’m in the money business. So I tried starting a bunch of different businesses when I got to school.

I had a clothing company, an ATM company, and they all got off the ground because I was a wild man. I could go out and promote and make things happen, but I couldn’t build companies. It wasn’t until I really partnered with my geeky little business partner who could build a product that things started happening. That just happened to be that his knowledge was Google AdWords at that time before people really understood what Google AdWords was or how to use it.

I remember when I was a sophomore in college in 2003 and the Google IPO. I remember people asking me, “Should I buy this? Google Ads, it’s the next thing.”  I didn’t understand what AdWords was but there was this smart Chinese kid that I saw around. I knew the kid was making money but he was very sly, very quiet about it. I just became friends with him anyway I could. I took him out for the first time, got him laid for the first time, and then got him drunk for the first time. I did everything I could to partner with this guy and literally what we were doing was in the IT space. He was doing AdWord arbitrage which eventually led to me going out and making deals with the mobile carriers directly to our own products that we could go promote and just widen our margins and we were the first guys advertising and buying traffic on Facebook.

I didn’t understand what AdWords was but there was this smart Chinese kid that I saw around. I knew the kid was making money but he was very sly, very quiet about it. I just became friends with him anyway I could. I took him out for the first time, got him laid for the first time, and then got him drunk for the first time. I did everything I could to partner with this guy and literally what we were doing was in the IT space. He was doing AdWord arbitrage which eventually led to me going out and making deals with the mobile carriers directly to our own products that we could go promote and just widen our margins and we were the first guys advertising and buying traffic on Facebook.

Lot of people think they have the next million dollar idea but have no idea the reality of entrepreneurship. What is the reality check you want entrepreneurs to know?

When I got to school, I saw and heard the term innovation a lot and if I were to build a college these days, I would throw ‘innovation’ out the window because all kids these days are like “Be innovative. You need to have a platform that is world changing and blah blah blah.”

As an Angel Investor, I see it every day. People try to bring me innovative ideas and I say, “Well how does this innovative idea make you a dollar?” “I don’t know. There are seven different ways.” No dude, it’s not like that. I would rather invest in my cleaning lady and give her $100,000 to scale up and buy some more vans and labor and go clean more houses because I get that. There’s revenue there. Business is all about getting something for a $1 and selling it for $3. That’s the point.

As an Angel Investor, I see it every day. People try to bring me innovative ideas and I say, “Well how does this innovative idea make you a dollar?” “I don’t know. There are seven different ways.” No dude, it’s not like that. I would rather invest in my cleaning lady and give her $100,000 to scale up and buy some more vans and labor and go clean more houses because I get that. There’s revenue there. Business is all about getting something for a $1 and selling it for $3. That’s the point.

Sometimes, I think people who want to get into the business, watch The Social Network and they are like, “Oh, I’m going to have some innovative idea this is going to be huge. I don’t know how big it’s going to be.” Those are the people who end up never sustaining it. I took a company public this January and now have 10 employees. What am I thinking about? I’m thinking about building a profitable business to support these people and making it work. All I’m thinking about is getting products for $1, selling them for $3, and taking home a couple cents at the end of the day.

A good revenue model is very different than an innovative idea because when these kids come to me with their app that’s going to tell me how to get to the nearest public restroom, and I say, “How do you monetize that?” They say, “Through advertising.” I just don’t get it so explain it to me. Focus on economics before you focus on innovation and perhaps that would probably lead you to be innovative rather than going the other way.

As a serial entrepreneur and avid angel investor, what will grab your attention when being pitched?

The number one thing you can have that would automatically get my attention are customers and customer data. The young kids are more fun because they are easier to teach and mold. The old guys are harder to get to think like you need them to think. Number one is customer data. You’ve got to remember, when you try raising money, it’s all about one thing. You’re not going to just show up to somebody’s office with an idea you woke up in the morning with and get money. That’s not anything anyone wants to invest in.

The number one thing you can have that would automatically get my attention are customers and customer data. The young kids are more fun because they are easier to teach and mold. The old guys are harder to get to think like you need them to think. Number one is customer data. You’ve got to remember, when you try raising money, it’s all about one thing. You’re not going to just show up to somebody’s office with an idea you woke up in the morning with and get money. That’s not anything anyone wants to invest in.

People want to invest in a built product in a platform that is already built that has some traction. So if you’ve got a website or you’ve got a social network or you’ve got a fantasy sports platform, investors want to see 1,000, 10,000, 100,000 users on that platform and start having conversations like “Well, what is one user worth to you?” In fact, you don’t want even the investor to say that. You want to say to the investor, “Look, here’s my data. Over the last six months, one user is worth $10 to me. I’d like to go out and do Google AdWords or certain media campaigns and I don’t like to acquire users for $5. Lend me $5 million. Let me go out and get 500,000 more users. They are going to each be worth $10. I’m going to pay you back in six months. I’m going to let you keep 10% equity.” Now that is a mature conversation.

How important is it to have a viable product or business rather than just an idea?

People always come in looking to raise money for their idea before their product or platforms are built. Today with the internet and the ability to outsource development, go on Craigslist and hustle up. If you have an idea, go find a friend who understands tech better than you. Get this thing mocked up and then go and try to be entrepreneurial and get people to sign up. I don’t care if it’s knocking on people’s doors, “Hey sign up for my website and tell me how you like it.” If that’s the type of person you are, you deserve to be in my living room. If you’re just like, “This is my idea and development is going to cost like $500,000.” I’m not investing in your education.

People always come in looking to raise money for their idea before their product or platforms are built. Today with the internet and the ability to outsource development, go on Craigslist and hustle up. If you have an idea, go find a friend who understands tech better than you. Get this thing mocked up and then go and try to be entrepreneurial and get people to sign up. I don’t care if it’s knocking on people’s doors, “Hey sign up for my website and tell me how you like it.” If that’s the type of person you are, you deserve to be in my living room. If you’re just like, “This is my idea and development is going to cost like $500,000.” I’m not investing in your education.

They often say investors invest in people rather than businesses. Do you follow that philosophy?

Revenue models are important but the people are huge too. 95% of all ideas that come through your window are crap. They don’t have a revenue model. So of those 5% of people that actually have a legit, business and revenue growth model, I’d say like 5% of those businesses will actually make it so you’ve got to be relentless and unwilling to settle for average.

I’m teaching this class one day and these two Greek twin brothers came in while I was teaching. They were talking about this supplement company that they have started from their dorm room called Grecian Ideal Nutrition. Just through straight hustling, they’ve got it on the shelves in Albertson’s which is a 1,000 store chain in the south, bodybuilding.com, and had a huge cult following among the pro sports teams. So they sat down with me for coffee after this class and they were like, “We have a really slow growth pace because we were cash strapped. We don’t even have enough money to reorder the inventory that these guys are purchasing from us.”

I looked through their all stuff and I was very blunt with them. I said, “Look you have no assets for me to invest in besides the connections you’ve made in the space and your knowledge of the space, and I don’t really like your brand. This Grecian Ideal Nutrition thing is you guys. You’re Greek twin brothers, I get it. If I’m going to put a bunch of money in, I want to be stoked on the idea because I’m a meathead too. I want to be excited about the company.” But I kept these kids in mind because these kids are such grinders. They live in Jersey but if a gym owner down in Miami calls them up on their products, they get in their Ford Explorer and they grind it out. They just go and that is huge.

Eventually you partnered up with those guys and helped them

I texted these guys the other day. I was like, “Hey I want to have a sit down. I think we get things done when we’re in the same room. I want to work on branding a little bit.” Boom, they were in their car and on their way to me. I’m like, “I guess I’m not golfing this afternoon.” They are just legit and what’s interesting about that is usually, we probably wouldn’t have a chance to work together but I have a buddy in Vancouver who sold the stock brokerage in the 90s for a couple hundred million and he is always taking companies public.

I said to the guy, “What do you think about nutritional products?” He goes, “You know that could be really hot.” I said, “Okay, so what? We’re going to outlay money and put this stuff on the shelves at GMC”. I get it but that’s not really jacking me up but I kept thinking about it. How did I make money in my past businesses, Tatto Media, we’re all about subscriptions, right?

I said to the guy, “What do you think about nutritional products?” He goes, “You know that could be really hot.” I said, “Okay, so what? We’re going to outlay money and put this stuff on the shelves at GMC”. I get it but that’s not really jacking me up but I kept thinking about it. How did I make money in my past businesses, Tatto Media, we’re all about subscriptions, right?

So I’m watching television and a Proactiv commercial comes on TV. I love Proactiv, why? Because you got kids sitting at home who are self-conscious with bad skin and what happens? They call in and on the 30th of the month, their credit card gets whacked and they get sent product. They don’t have to keep selling more and more people. They are just growing their existing customer base. So who is doing that in the nutrition space? Well, you change the channel to CNBC now, what do you see? You see Carl Icahn and Bill Ackman fighting over HerbaLife. Bill Ackman is saying, “This is a multilevel marketing scam. I’m going short. Carl Icahn says, “Bring it on. We do $4 billion top line a year and $100 million to the bottom line.”

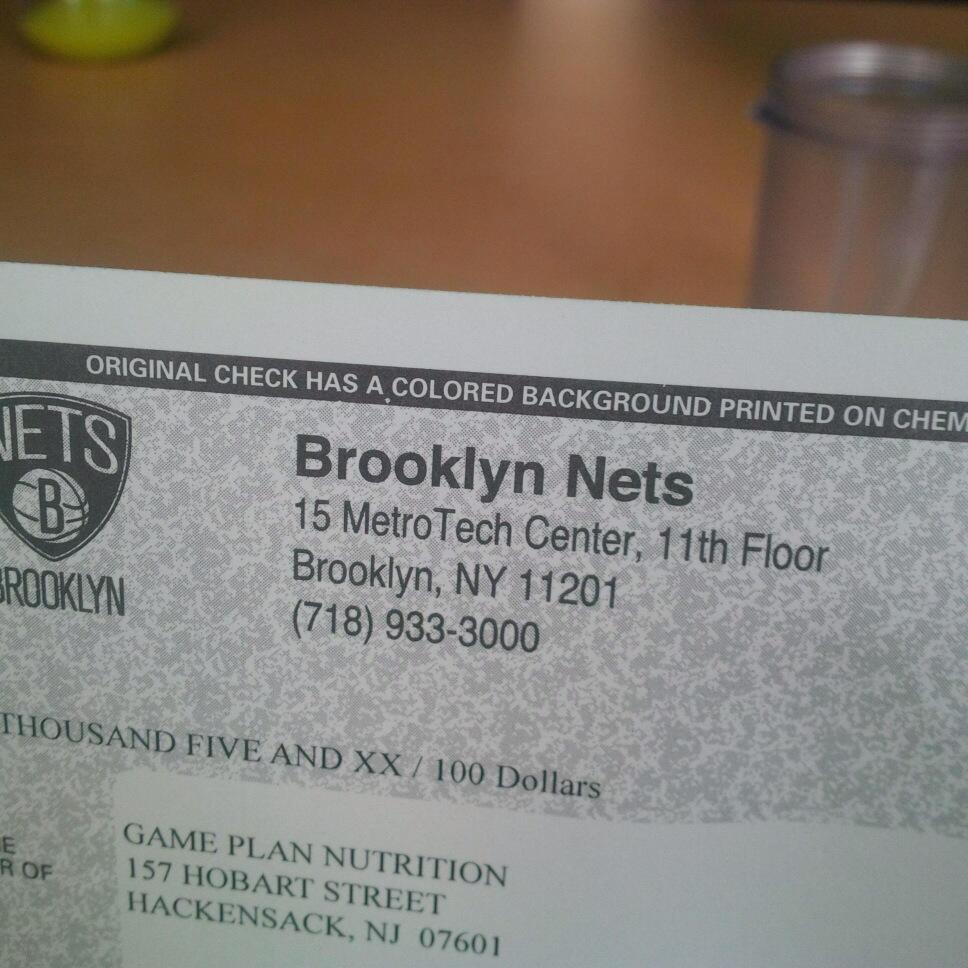

New companies out there like Visalus are selling subscription protein shakes, the sellers are on a commission basis and doing $500 million a year. So now I’m starting to think. We’re having conversations and we realize who has access to people that are willing to pay on a recurring basis and who needs a supplemental income? The answer is personal trainers so we’re building affiliates in this supplement model where we’ve named the company Game Plan Nutrition and we’re really building a model that is high quality but really targeted towards not working with the brick and mortar retailers that take a lot of your margins.

New companies out there like Visalus are selling subscription protein shakes, the sellers are on a commission basis and doing $500 million a year. So now I’m starting to think. We’re having conversations and we realize who has access to people that are willing to pay on a recurring basis and who needs a supplemental income? The answer is personal trainers so we’re building affiliates in this supplement model where we’ve named the company Game Plan Nutrition and we’re really building a model that is high quality but really targeted towards not working with the brick and mortar retailers that take a lot of your margins.

My father had a lot of friends who were in the denim or the slipper businesses and they used to go to Hong Kong and always come over and talk to me about working with Wal-Mart and explaining to me how they lived on no margins because to work with Wal-Mart and get their volume of all the people that walk through their stores, they get to dictate really what they want to sell their product for. So by building our own distribution channel and a subscription system, that’s what we’re trying to accomplish with this and become the next HerbaLife idea.

Won’t some people think your business is a MLM or pyramid scheme?

I would call it more of an affiliate network and to be honest, I don’t think MLM is as a bad as the term sounds.  In terms of customer data, eventually, I’m going to know what one customer is worth for me so I’m going to be able to offer a commission for a trainer for bringing me that customer and that trainer is then going to have a supplemental income. My personal trainer says to me the other day, “Go to GNC and buy the ISO Pure protein. It has got the highest protein to carb ratio.” The guy makes no commission off that yet the kid sells weed on the side.

In terms of customer data, eventually, I’m going to know what one customer is worth for me so I’m going to be able to offer a commission for a trainer for bringing me that customer and that trainer is then going to have a supplemental income. My personal trainer says to me the other day, “Go to GNC and buy the ISO Pure protein. It has got the highest protein to carb ratio.” The guy makes no commission off that yet the kid sells weed on the side.

So it’s really about building that supplemental income for them because these guys have clients they work with already monthly that they could be monetizing and making more money than they are. So once I have customer data, I will be able to know how I can incentivize these trainers but not only will I be able to figure out what one customer is worth, I’ll be able to figure out what one trainer is worth because they will bring me several customers. So I want to incentivize trainers to bring me other trainers. Now does that mean MLM or Pyramid? I hope not. I want to do my research and stay away from any sort of negative things that have been associated with the Herbalifes, the Avons, the Amways or the other things and really understand how I can build a cleaner and better model, but it is part of the deal.

After exiting two companies for millions of dollars, you started a hedge fund. Why?

I sold my shares of Scambook in July 2012, which was last summer and I was just hanging out for a while, playing golf and clearing my mind. I realized my next deal should be not only something that helps me preserve the money I’ve made but also allows me to have a successful platform for the next steps with investors that made a lot of money off my past businesses. I didn’t need to go out and raise $200,000 for my next startup. So what could I build to really scale this up? I talked to my friend off Wall Street who is tremendously successful. He is an Israeli immigrant, parents are holocaust survivors, he is really conservative and he has been managing my money and my parents’ money passively while he was still on the street for a while.

I sold my shares of Scambook in July 2012, which was last summer and I was just hanging out for a while, playing golf and clearing my mind. I realized my next deal should be not only something that helps me preserve the money I’ve made but also allows me to have a successful platform for the next steps with investors that made a lot of money off my past businesses. I didn’t need to go out and raise $200,000 for my next startup. So what could I build to really scale this up? I talked to my friend off Wall Street who is tremendously successful. He is an Israeli immigrant, parents are holocaust survivors, he is really conservative and he has been managing my money and my parents’ money passively while he was still on the street for a while.

The great thing about the hedge fund platform for me is that it’s clear. When I was doing things like Tatto Media or some of my other businesses, I really relied on the business partner that I was referring to for a lot of the technical stuff that I didn’t understand. Often times, when I would ask him questions, it would weigh on our relationship so I just really became a really good role player. It was a lot of anxiety because I never knew when he would call me up and say, “Bad news, carrier’s can’t pay us for another 90 days. We’re going to have to be creative.” Even though there’s a lot of pressure, rule number one, you’ve got to perform and there’s a lot of regulations and stuff, but I have so much clarity and no anxiety at all even though there’s a lot of high pressured times but it’s just being clear and being excited.

For those not in the know, how does a hedge fund work on both ends?

At the end of the day, a hedge fund is very simple. You take a management fee and a percent of profits. So an investor gives you a $100 million, you give it to your trader that you believe can outperform everyone on the street. He turns that $100 million to $200 million. You return 80% of the profits to the investor and the fund keeps 20%. That’s the deal, you get 20% of the profits and you also take a management fee which helps you with your operating cost of business. So usually on the street, it’s between 1% and 2%, so you take 2% on the $100 million so you just made yourself $24 million in a year. So that’s clear. That’s real. I won’t say that’s innovative. It’s just pretty straightforward, how we going to make the money.

How do you attract people to invest in your hedge fund?

The hedge fund is built for me because it allows me to do what I do well every day, which is go out and play a lot of golf, drive my fancy car around and have people say, “Who is this guy? He has to come up to me and meet me,” and that’s really what I am. I’m a salesman. I meet older guys and I try to impress them with my track record and get to know them, and then say, “Hey, why won’t you put $500,000 in my fund and watch our newsletter over the next couple of months? If we outperform your other asset managers, then we’ll talk about a larger injection, $5 million, $10 million, whatever.

The hedge fund is built for me because it allows me to do what I do well every day, which is go out and play a lot of golf, drive my fancy car around and have people say, “Who is this guy? He has to come up to me and meet me,” and that’s really what I am. I’m a salesman. I meet older guys and I try to impress them with my track record and get to know them, and then say, “Hey, why won’t you put $500,000 in my fund and watch our newsletter over the next couple of months? If we outperform your other asset managers, then we’ll talk about a larger injection, $5 million, $10 million, whatever.

Think about it, man. You’re an investor. You’ve got $10 million in the bank, you want to turn that $10 million into $100 million. What are you going to bet on? A lot of it is human personality and human species. There have been times before where I’ve got investors and deals where the return ended up only being like 10-15%.  I wanted to fabricate returns and pay them out of pockets to make more money so that they thought of me like a bigger winner. That’s really the key. It’s like really making people know and trust that when they give you their money, you’re going to bring it back and then some. It has been tough. I’ve never really had an investment I’ve made passively return me anything.

I wanted to fabricate returns and pay them out of pockets to make more money so that they thought of me like a bigger winner. That’s really the key. It’s like really making people know and trust that when they give you their money, you’re going to bring it back and then some. It has been tough. I’ve never really had an investment I’ve made passively return me anything.

At the end of the day, I’ve got my portfolio manager who lives, eats, and breathes trading in the markets who wakes up every day. When he’s on the toilet, he’s on Bloomberg, on his Blackberry and he really doesn’t miss a beat. That’s what he does but he’s a real product for me to then be able to actually take a $25 million check from somebody and do something responsible and make them go to sleep every night and say, “Well, that Andrew is the real deal. I’m happy I’m working with him.” That for me, that’s the platform. That’s the hedge fund and the public company is called GPOH, which I took public.

You sold Tatto Media for $60 million. How did that happen and what’s it feel like?

That’s a great question. It’s something you should never plan on or think about because people are always like, “Oh yeah, we’re going to sell or we’re going to exit.” Bullshit. To sell your company, someone has got to be there willing to buy you. To sell your shares, someone has got to be willing to buy them, and you can’t plan on that happening. It happens with hard work and time.

That’s a great question. It’s something you should never plan on or think about because people are always like, “Oh yeah, we’re going to sell or we’re going to exit.” Bullshit. To sell your company, someone has got to be there willing to buy you. To sell your shares, someone has got to be willing to buy them, and you can’t plan on that happening. It happens with hard work and time.

Tatto, for instance, the company that bought us was actually lending us money. In our space, we get paid by the mobile carriers four times a year, that’s it, net 90, every 90 days. To get paid, we had to wait 90 days. In some of our partnerships in traffic relationships, we were paying people weekly. So we’re paying out weekly and waiting to get our money every 90 days. There is a significant amount of cash flow that we had to deal with. We had a company that we met.  Long story how we met them but they started factoring our payments, meaning they were willing to lend us the money upfront and then take a small percentage when we got that check 90 days later.

Long story how we met them but they started factoring our payments, meaning they were willing to lend us the money upfront and then take a small percentage when we got that check 90 days later.

So they became comfortable with our business model. We’re talking about big transactions here. You don’t just walk into someone’s office and start talking about doing $100 million transactions. They got comfortable with us realizing we were the real deal, it just so happened that they were going to go public in Hong Kong and they wanted to acquire revenue. The deal made sense for us. I was at a point where I built the business for six years and I was running around, people wanted to hear from me and talk to me and I was saying, “Oh I built this company and we do $10 million a year…blah blah.” You know, bullshit. I really wanted to say I sold my company. That was my chance and that’s what we did.

After all your success, do you think you’ve found your purpose?

You know what, if someone says to me, “Where do you see yourself in five years?” I ignore that question. I go back to what I said about people thinking that college was the best time of their life because every day I wake up, I have to have that goal and that platform that works for me or else I get really depressed. For instance, without this hedge fund, if you say like, “Hey Andrew, I’ve got a great guy down here at Miami you should meet, this big real estate guy.” What happens? I go to a meeting with this guy, we have lunch, we hit it off, and we jerk each other off talking about like “Oh you do real estate? I’m in internet, great to meet you.” Now if I walk into a meeting like that, I know what I’m doing. I’m going to make this guy like me and at the end of this meeting I’m going to convince him to put $500,000 to $1 million test in my hedge fund. Boom, I’m there for a reason. I know what I’m doing. I’m not just wasting my time. That makes me feel like I have a purpose.

Cite: The content of this listing and interview has been published by Secret Entourage — http://www.secretentourage.com/success-stories/andrew-bachman-gameplan/